FPIs additionally invested ₹14,955 crore within the debt market in June.

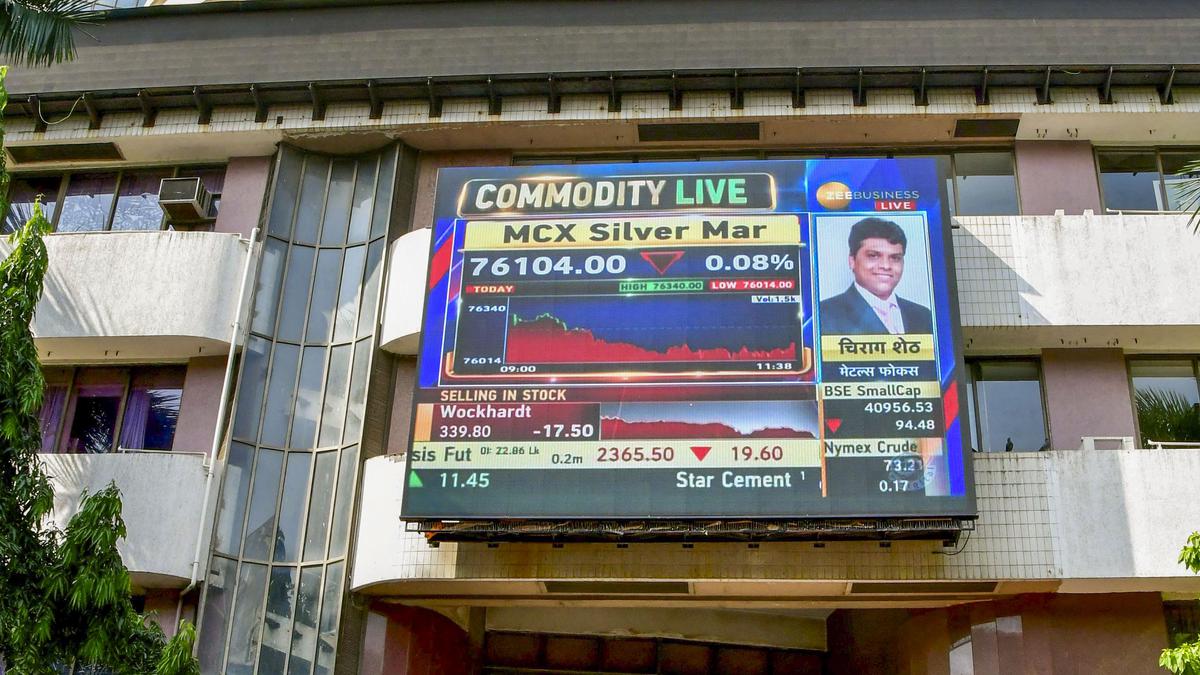

| Picture Credit score: PTI

After two months of web outflow, overseas traders turned patrons in June, infusing ₹26,565 crore in Indian equities, pushed by political stability and a pointy rebound in markets.

“Trying forward, consideration will steadily shift in direction of the Funds and Q1 FY25 earnings, which may decide the sustainability of FPI flows,” Vipul Bhowar, director, Listed Investments, Waterfield Advisors, mentioned.

In line with the information with the depositories, International Portfolio Traders (FPIs) have made a web infusion of ₹26,565 crore in equities this month.

This got here following a web outflow of ₹25,586 crore in Might on ballot jitters and greater than ₹8,700 crore in April on issues over a tweak in India’s tax treaty with Mauritius and a sustained rise in U.S. bond yields.

Earlier than that, FPIs made a web funding of ₹35,098 crore in March and ₹1,539 crore in February, whereas they took out ₹25,743 crore in January. The web outflow now stood at ₹3,200 crore within the month, information with the depositories confirmed.

Geojit Monetary Providers Chief Funding Strategist V. Ok. Vijayakumar mentioned political stability, regardless of the BJP not getting a majority by itself, and the sharp rebound in markets aided by regular home institutional traders (DIIs) shopping for and aggressive retail shopping for, has compelled the FPIs to show patrons in India.

“Nevertheless, the FPI shopping for has been focussed on a number of particular shares relatively than being widespread throughout the market or sectors. It’s because Indian equities are nonetheless thought of overvalued by FPIs,” Mr. Bhowar mentioned.

They’re favouring the monetary, auto, capital items, actual property, and choose shopper sectors.

“With authorities stability assured, spectacular GDP efficiency and forecasts, secure shopper worth index, ample foreign exchange reserves and strong banking sector well being, I anticipate a gentle and substantial FPI influx,” Kislay Upadhyay, smallcase Supervisor & Founder Fidelfolio, mentioned.

Moreover, FPIs invested ₹14,955 crore within the debt market in June. With this, FPIs’ funding within the debt market reached ₹68,624 crore in 2024 up to now. India’s inclusion within the JP Morgan Bond Index is optimistic.

In the long run, this may cut back the price of borrowing for the federal government and the price of capital for corporates. That is optimistic for the economic system and subsequently, for the fairness and debt market.